Public Finance Authority

PFA’s local public benefit mission provides local governments with a voice and a vote in these projects that helps to create temporary and permanent jobs, build affordable housing, invest in infrastructure to improve our communities, and provide financing for nonprofit projects within a wide range of industries from healthcare to education to community service organizations.

Independent Registered Municipal Advisor Exemption

By publicly posting the following written disclosure, the Public Finance Authority (“PFA”) intends that market participants receive and use it for purposes of the independent registered municipal advisor exemption to the SEC Municipal Advisor Rule. PFA has retained an independent registered municipal advisor. PFA is represented by and will rely on its municipal advisor GPM Municipal Advisors, LLC (“GPM”) to provide advice on proposals from financial services firms concerning the issuance of municipal securities and municipal financial products. This certificate may be relied upon until July 1, 2025. Proposals may be addressed to PFA, care of any of the Program Managers listed on PFA’s Contact Us page. All proposals received will be shared with PFA’s municipal advisor.

Contact us today at (888) 508-7188

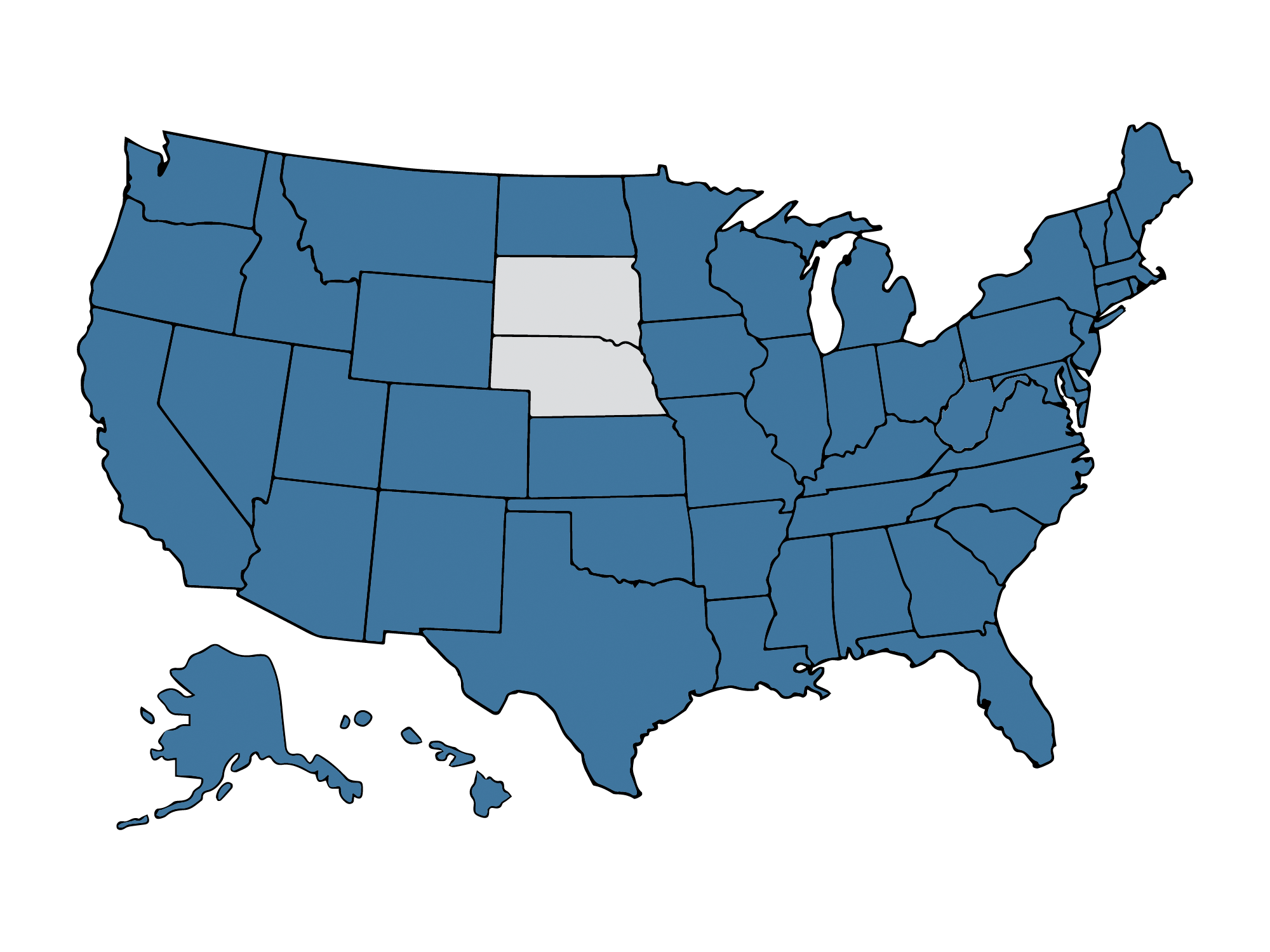

Nationwide Reach with PFA

PFA has issued bonds for projects in 47 states.